Florida woman convicted in $3.4M tax fraud scheme after being on the run for 8 years: DOJ

A Florida woman who was indicted nearly 10 years ago was convicted of tax fraud after authorities found her in New Mexico, according to the Department of Justice.

Judy Grace Sellers is facing up to 23 years in federal prison after she promoted the improper use of IRS form 1099-OID to commit tax fraud, the DOJ said.

Sellers operated a website where she "perpetuated the false premise that the U.S Treasury maintains secret accounts attributed to every U.S. citizen that can be drawn on by filing a series of bogus documents with the U.S. Treasury and other government entities."

As part of the scheme, Sellers and her co-conspirators promoted the use of form 1099-OID where they prepared and submitted fraudulent returns seeking massive refunds. One case exceeded more than half a million dollars.

According to the DOJ, all of the forms were based on non-existent 1099-OID income and withholdings. The scheme resulted in 22 forms being submitted requesting fraudulent refunds amounting to $3.4 million from the IRS.

In 2014, Sellers was indicted for tax fraud charges and for filing a false lien against two DOJ attorneys. She was placed on house arrest in 2015 along with a GPS ankle monitor.

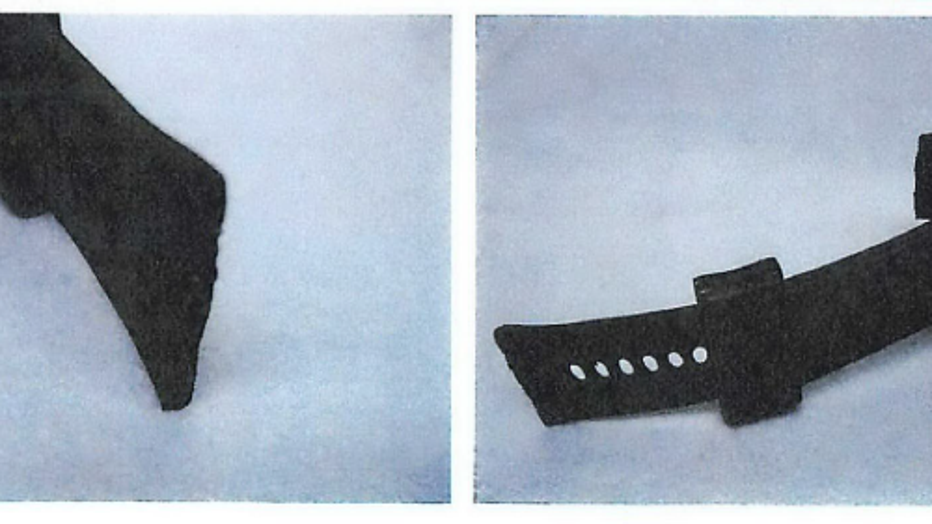

At some point that year, Sellers was given permission to leave her home to get her hair done in preparation for her pretrial hearing. The next day, she cut off her ankle monitor and absconded.

Credit: DOJ

It took authorities eight and a half years to find Sellers in New Mexico.

Her sentencing hearing is scheduled for May 22, 2024.