Seeking debt relief? Here’s how credit counseling can help

Nonprofit credit counseling agencies offer free or low-cost financial services for consumers who are struggling to manage debt or considering bankruptcy. Here's what a credit counselor can do for you. (iStock)

Unmanageable high-interest debt can be a heavy burden on a consumer's finances. It can seem like no matter how much you try to pay it off, the balances keep growing as interest accrues over time.

Ten percent of Americans fear missing a minimum debt payment over the next 3 months, according to the Federal Reserve Bank of New York. Becoming delinquent on debt may result in some consumers considering bankruptcy — and in the worst cases, debt collectors can sue borrowers over unpaid debt, resulting in wage garnishment.

If you're struggling to repay debt, you may consider seeking the help of a nonprofit credit counseling agency. Credit counselors can help you come up with a plan to repay multiple types of debt, such as credit cards, unpaid medical bills and payday loans.

Keep reading to learn more about credit counseling, as well as your alternative debt consolidation options. You can compare debt consolidation loan interest rates for free without impacting your credit score on Credible.

4 MONEY MANAGEMENT STRATEGIES TO HELP IMPROVE YOUR FINANCES

What is credit counseling?

Nonprofit credit counseling agencies offer free and low-cost financial services to consumers who are struggling to manage their debts. Some consumers who are filing for bankruptcy may be required to seek credit counseling as part of their court filings. A credit counselor may help you by:

- Providing advice on how to manage your money and debts

- Analyzing your finances and creating a monthly budget

- Obtaining free copies of your credit report and credit scores

- Enrolling you in a debt management plan (DMP), which may come at a monthly cost

- Negotiating with your creditors on your behalf to reduce interest rates and waive late fees

Consumers should be aware that some for-profit debt management companies may disguise themselves as nonprofit organizations. A reputable credit counseling agency should send you free information about the services it provides, according to the Consumer Financial Protection Bureau (CFPB). If a counselor isn't willing to provide this information, this is a red flag.

You can find reputable credit counselors through a few trade organizations, such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). You can also see a full list of approved credit counseling agencies on the Department of Justice website.

To learn more about your alternative debt consolidation options, get in touch with a knowledgeable loan expert at Credible.

STUDENT LOAN BORROWERS CAN POTENTIALLY SAVE $5K BY REFINANCING

3 alternative debt payoff methods

Credit counseling is a relatively low-risk way to manage multiple debts, but it's not your only option. Here are a few other strategies for paying off debt fast.

1. Debt avalanche or debt snowball

The debt avalanche method is when you pay off the debts with the highest interest rate first to save the most amount of money over time. On the other hand, the debt snowball method is when you repay the smallest balances first to gain momentum on your debt payoff plan.

PERSONAL LOAN OR HOME EQUITY LOAN: WHICH IS BETTER?

2. Credit card balance transfers

It may be possible to move the balance of one or multiple credit cards onto a new account at a lower interest rate through a balance transfer card. Credit card issuers typically charge a balance-transfer fee equal to 3-5% of the total amount.

Some consumers may even qualify for an introductory 0% APR offer, which allows you to pay off your credit card debt over a period of up to 18 months without interest. These promotions are typically reserved for borrowers with very good to excellent credit, which is defined by the FICO model as 740 or above.

You can compare balance-transfer cards across multiple credit card issuers at once on Credible.

HOW LONG SHOULD YOUR PERSONAL LOAN TERMS BE?

3. Debt consolidation loans

A debt consolidation loan is a type of personal loan that's used to repay unsecured debt at a lower, fixed rate. Personal loans are lump-sum loans that you repay in monthly installments over a set period of time, typically a few years.

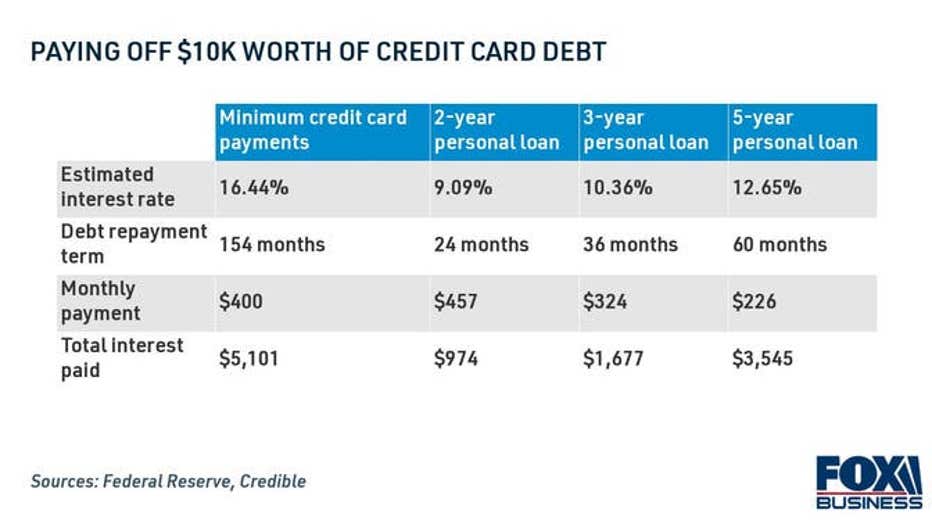

Two-year personal loan interest rates are currently at record lows, according to the Federal Reserve, which means there's never been a better opportunity to refinance your debt at a lower rate. Keep in mind that the interest rate you qualify for depends on your credit score and debt-to-income ratio.

A recent analysis estimates that well-qualified applicants can potentially save up to $174 on their monthly payments by consolidating their credit card debt into a personal loan. Over time, this may translate to thousands of dollars worth of savings in interest charges.

If you're curious about this strategy, use a personal loan calculator to estimate your monthly payments. You can also visit Credible to compare debt consolidation loan interest rates to determine if this debt repayment strategy is right for your financial situation.

HOW TO GET A $50,000 PERSONAL LOAN AMOUNT

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.