Student loan payment pause extended to borrowers who have defaulted on private loans

WASHINGTON - The federal government has extended a pause on student loan payments that covers more than 1 million people who have defaulted on loans held by private lenders, the Education Department announced Tuesday.

The department said approximately 1.14 million borrowers who defaulted on their loans in the Federal Family Education Loan (FFEL) Program, which is now defunct, will receive a payment pause and 0% interest rate.

The FFEL Program allowed private lenders to provide student loans that were backed by the federal government. The program ended in 2010 when the Education Department became the sole lender of federally subsidized student loans.

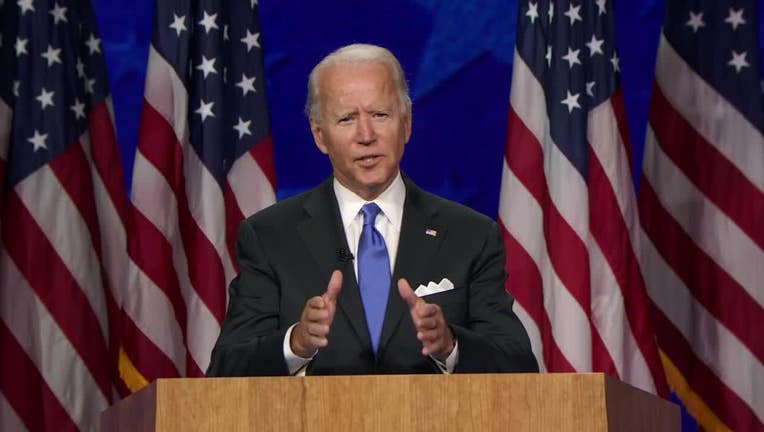

President Joe Biden announced in January that federal student loan payments would remain suspended and interest rates would be set at 0% through at least Sept. 30, extending an action from the administration of former President Donald Trump. But it applied only to those with debt held directly by the federal government, leaving out millions with private student loans.

Education Secretary Miguel Cardona on Monday said the extension of the payment pause would help up to 800,000 borrowers who were at risk of having their tax refunds seized to repay a defaulted loan.

Speaking at a press briefing on Monday, White House press secretary Jen Psaki said, "This step particularly protects 800,000 borrowers who are at risk of having their tax refunds seized. That’s actually a pretty significant step."

"At a time when many student loan borrowers have faced economic uncertainty, we’re ensuring that relief already provided to borrowers of loans held by the Department is available to more borrowers who need the same help so they can focus on meeting their basic needs," said Cardona. "Our goal is to enable these borrowers who are struggling in default to get the same protections previously made available to tens of millions of other borrowers to help weather the uncertainty of the pandemic."

Advocacy groups called the measure a good start but said it fails to help more than 5 million other borrowers in the same program, known as the Federal Family Education Loan Program.

"This is not enough," said Persis Yu, director of the National Consumer Law Center’s Student Loan Borrower Assistance project. "The millions of FFEL borrowers who have not yet defaulted but who may be struggling to make their student loan payments often at the expense of other vital necessities need relief."

Democratic lawmakers, along with a group of 17 state attorneys general and consumer rights advocates have called on Biden to cancel up to $50,000 in federal student loans via executive order.

The president has said that he backs $10,000 in blanket forgiveness for federal student loan borrowers through congressional action. During a CNN town hall on Feb. 16, he said that he doesn’t support $50,000 of forgiveness.

Psaki said that Biden is continuing to urge Congress to cancel $10,000 in student loan debt.

"That’s something Congress could take an action on, and he’d be happy to sign," she said.

The Associated Press contributed to this story.